Send sample deferred compensation agreement via email, link, or fax. You can also download it, export it or print it out.

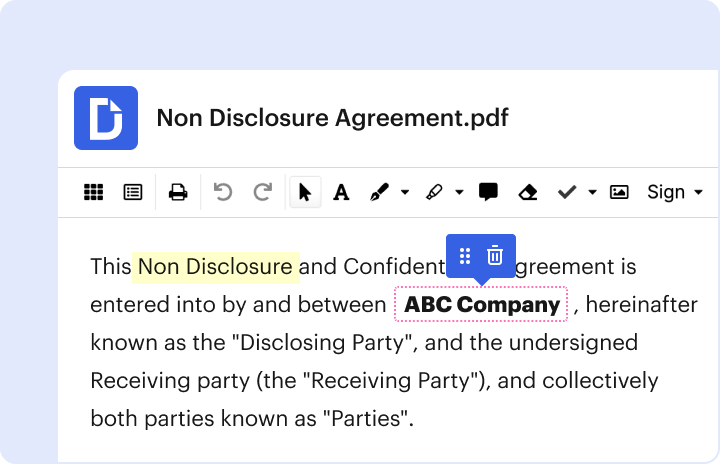

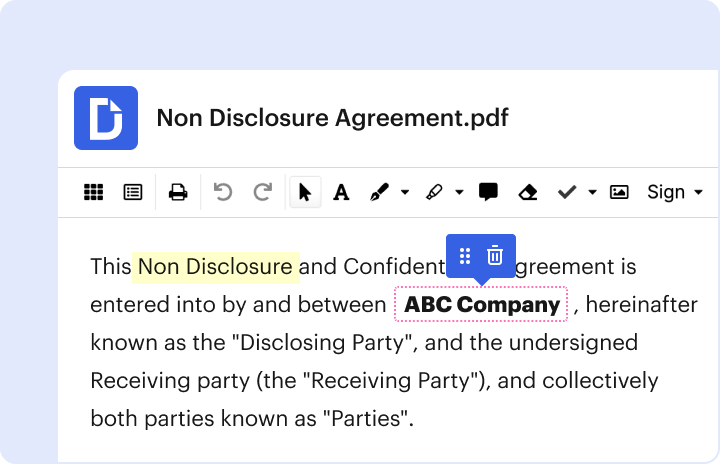

With DocHub, making changes to your documentation takes just a few simple clicks. Follow these fast steps to modify the PDF Deferred compensation agreement online for free:

Our editor is super intuitive and efficient. Try it out now!

Fill out deferred compensation agreement onlineWe have answers to the most popular questions from our customers. If you can't find an answer to your question, please contact us.

How is deferred compensation paid out?Deferred compensation plans dont have required minimum distributions, either. Based upon your plan options, generally, you may choose 1 of 2 ways to receive your deferred compensation: as a lump-sum payment or in installments.

What are the two major advantages of using deferred compensation?Benefits of a deferred compensation plan, whether qualified or not, include tax savings, the realization of capital gains, and pre-retirement distributions.

Who benefits from a deferred compensation plan?Which Employees Should Choose a Deferred Compensation Plan? Because deferred compensation plans help to reduce taxable income, these plans are often used for high-income earners who have maxxed out their 401 (k) or other retirement plans.

What is a deferred compensation agreement?A deferred compensation plan allows a portion of an employees compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

Why would I want deferred compensation?A deferred compensation plan allows a portion of an employees compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

deferred compensation agreement template employee deferred compensation agreement sample non qualified deferred compensation agreement deferred compensation plan 457 deferred compensation plan withdrawal deferred bonus agreement nonqualified deferred compensation plan deferred compensation california

Contribute a Set Percentage One easy way to increase your retirement savings is to contribute a percentage of your income to your Deferred Compensation Plan (DCP) account. Consider saving between 7% and 10% of your salary.

How much should I put in deferred compensation?Your Contributions One easy way to increase your retirement savings is to contribute a percentage of your income to your Deferred Compensation Plan (DCP) account. Consider saving between 7% and 10% of your salary.

How does deferred compensation plan work?A deferred compensation plan withholds a portion of an employees pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

What is the difference between a 401k and deferred comp?Deferred compensation plans are funded informally. Theres essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

What is an example of a deferred compensation plan?Examples of deferred compensation include retirement, pension, deferred savings and stock-option plans offered by employers. In many cases, you do not pay any taxes on the deferred income until you receive it as payment. Deferred compensation plans come in two types qualified and non-qualified.

Deferred Compensation Plan The Company has established for officers (including all of the Named Executive Officers) and certain other employees a Capital

Exhibit 10.3 - Deferred Compensation Agreement - SEC.govTHIS DEFERRED COMPENSATION AGREEMENT (the Deferred Compensation Agreement) by the Employer to defer up to 12 percent (12%) of the Employees salary.

457 Deferred Compensation Plan - UMN Policy LibraryYour investment contribution, also known as a salary deferral, can be a specific dollar amount per pay period or as a percentage of your pay.